Et tu, Jimmy Chill? - Clover Health is not Being Added to the Russell 2000 On Friday

Jim Cramer should know better

“We are all wrong so often that it amazes me that we can have any conviction at all over the direction of things to come. But we must.” - Jim Cramer

I’ll keep this short. Clover Health almost certainly not going into the Russell 2000 index tomorrow (Friday, June 25, 2021).

One of the contributing factors to the recent volatile trading in Clover Health (NASDAQ: CLOV), apart from mistaken notions about short interest in relation to float, and the involvement of area douche-about-town Chamath Palihapitiya, has been excitement around the possibility of Clover being added to the Russell 2000 Index on the pending annual reconstitution on Friday, June 25.

Indeed, on June 4 when Russell released its preliminary list of index additions, Clover Health appeared on the list (see here).

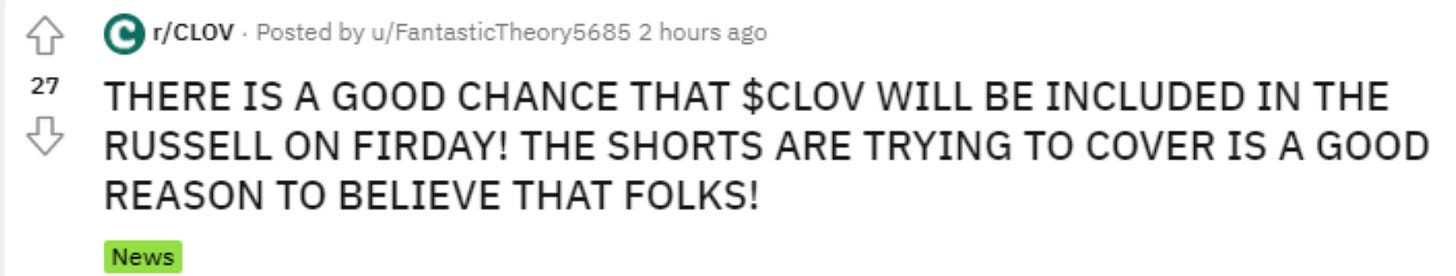

This preliminary indication from Russell helped pour some gas on the Reddit-fueled fire that was getting underway:

More recently, as the reconstitution date approaches, none other than Fast Money host Jim Cramer (also known by the self-anointed term “Jimmy Chill”) has waded into the mix, continuing a recent and disturbing trend of egging on the r/WallStreetBets crowd and taunting “the shorts” in several of these names. Perhaps he’s just laying the groundwork for changing his handle from Jimmy Chill to Jimmy Shill.

In any case, in recent days Mr. Cramer has been laying down the Boo-ya on Clover health, hyping a supposed inclusion in the Russell 2000 Index on June 25, and taunting the evil, nasty, probably-naked-and-certainly-desperate shorts about it:

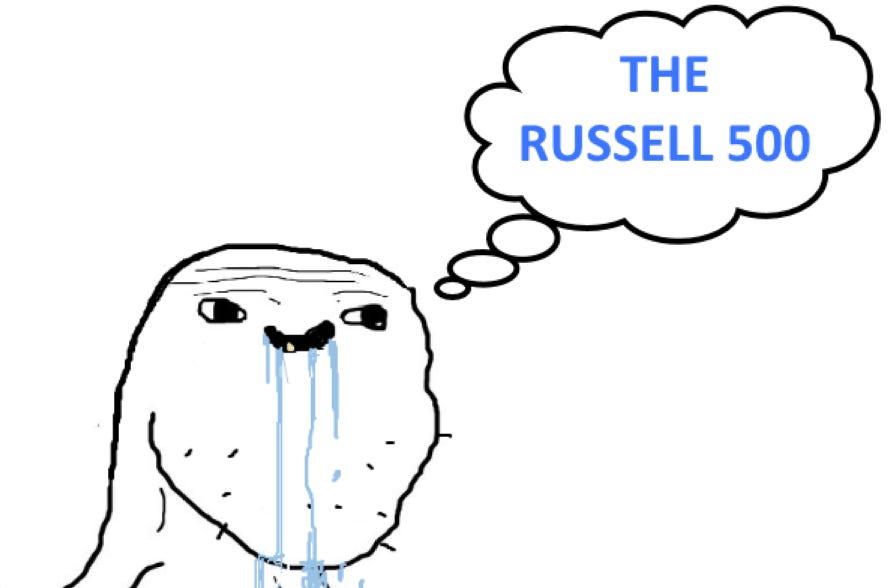

Naturally, the drooling hordes have been whipped up into a frenzy about it. A small sample below:

And a token post from the Reddit slurry pit:

Fortunately for those of us that do our own “DD”, FTSE Russell has a pretty transparent Index methodology that can be found at the link below:

Perhaps as way of throwing off the bloodhounds and followers of Jimmy Shill, FTSE Russell has given the very confusing title of “Russell U.S. Equity Indexes - Construction and Methodology” to the above document (that is sarcasm, for the lobotomized among you).

Included in this document are several criteria for index inclusion. Section 5.15 is of particular interest and shown below (note the highlighted portion in particular):

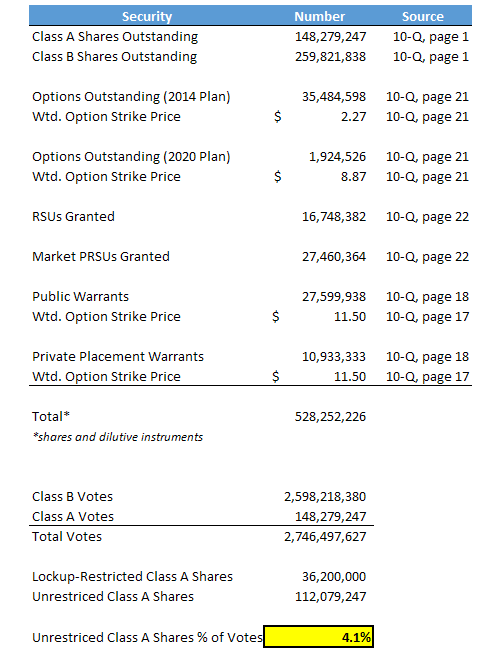

The 3 or 4 of us on the planet that have cracked an SEC filing for CLOV know that the company has Class B multiple voting shares, which are not traded, and each hold 10 votes per share (vs. one vote per Class A). We also know from that SEC FUD that there is a lockup agreement restricting not only the Class B shares but several holders of Class A shares. This lockup agreement expires on July 5 as outlined in my prior article (found here.)

Doing a bit of math:

We can see that Clover’s unrestricted shares are well below the 5% threshold required by the FTSE Russell Index Methodology.

Of course, nobody could expect Jim Cramer, a former hedge fund manager and pundit with decades of experience to familiarize himself with such trivia before giving information to his millions of followers. However, there have been other, ahem, “hints” that Clover isn’t being added to the Russell 2000 tomorrow that don’t require a few minutes of reading or some grade 3 math:

FTSE Russell has DROPPED Clover Health from its weekly preliminary index lists - if you look at the most recent update (from June 18) it does not appear:

FTSE Russell has EXPLICITY removed Clover from the list of additions in a correction note on June 10, explaining why it was removed from the list of index inclusions. Specifically, the voting rights highlighted above are referenced (Note the Russell 2000 is simply the bottom 2000 names in the Russell 3000).

It’s unclear how many people have been buying shares or options on Clover in anticipation of a Russell Index inclusion, following Jimmy Shill into the woodchipper once again. You get what you pay for, and free advice from TV blowhards is worth what you pay for it.

With hundreds of millions of Clover shares coming out of lockup on July 5, a fresh registration statement covering those shares filed on June 21, and what I believe is some level of pending Russell 2000 disappointment, it will be an interesting show over the next few weeks and into August when Q2 results are released.

“I’m not just here to tell you about stocks. I’m here to teach you to think like Cramer!” - Jim Cramer

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Assume I have a position. Assume I am wrong. This article represents my personal opinions only. It is not a recommendation to buy, sell, short, hold, or avoid any security. It should not be relied upon for any purpose other than entertainment. It’s probably so poorly written and researched as to be considered fiction. Numbers and analysis presented have not been proof-read or independently verified. Assume I am goofball. Despite my best efforts I make mistakes. I do get it wrong sometimes. I welcome comments and corrections. Do not assume I will update or comment further on a name. Always consult a (non-douchebag) financial advisor. Better yet, buy an index fund (scratch that, indexes are turning into clown cars lately). Be a good person. Stop crying and do your own work.

The Chamath clap back “do your own work” after cheating them. Sigh. Probably will never get old.

Debated sending the "Disclosure" to my CCO. Crying laughing.

Then realized, my children want me to keep my job...so there's that.

Is there a Keubiko Charity....Call? Sort of like Buffett's vaunted charity lunch? I would donate to a charity of your choice to have a 15 minute call and hear the story of the Keubiko.....the legend, the myth, the master of mayhem & mirth.

Name it. LFG.