In my last article, I provided an overview of the circus surrounding “MMTLP”, and how seemingly 10s of thousands of retail investors feel deeply violated by the fact their OTC penny stock get-rich-quick scheme, shockingly, didn’t make them rich. They feel that FINRA and the SEC did them dirty. They did not. Read up on that here:

MMTLP: You want it to be one way... But it's the other way.

“You want it to be one way… But it’s the other way.” - Marlo Stanfield, The Wire I’ve recently had the distinct pleasure of interacting with several former holders of “MMTLP”. I say “former” because the security no longer exists. Those lucky enough to be unfamiliar, consider yourselves blessed and stop reading. Ignorance is bliss. Trust me.

One thing I did not touch on in that article (which was mainly an attempt to correct egregious misunderstanding of basic market mechanics), was the what the instrument (MMTLP and the shares of Next Bridge Hydrocarbons that were distributed from it) might actually be worth.

While underlying valuation seems to be about #8 on the list of why people bought MMTLP, behind such apparent, yet perfectly legitimate in 2022, reasons as “sticking it to the naked shorts” and “ A cheap Sauvignon Blanc-drinkin’ lady in a bird hat on YouTube said I should buy it!”.

Source: https://www.youtube.com/live/M8olyX-XioQ?feature=share

The above-linked video viewed over 10,000 times by over 7,000 subscribers on December 7, 2022, gives some insight into what MMTLP investors were telling themselves the day after the Dec 6 corporate action notice from FINRA, and the critical December 8 date. Don’t forget to read the comments and scrolling chat and toast the end of your faith in the human species with some cheap Sauvignon Blanc.

Now that thousands of holders (via their own ignorance or inability to understand the corporate action) now feel “trapped” in shares of Next Bridge Hydrocarbons (“NBH”, the sole asset attached to MMTLP that was distributed in December, 2022), it may be worthwhile to consider what that asset may actually be worth.

First, a couple of quick facts. First, there were 165,523,363 shares of MMTLP:

Second, from the time MMPTLP began trading in October 2021 to when the assets were distributed (as shares of NBH) in December 2022, MMTLP traded between a low of $0.70, to an intraday high of $12.50 on November 22, 2022. The final trade on December 8 (the last day to buy or sell MMTLP and get or avoid the NBH distribution) was $2.90 per share.

Source: Bloomberg

Running the math, over this 14-month period MMTLP had a market capitalization between $116 million on the low end (at $0.70 per share) and $2.069 Billion (that’s billion, with a Big Baggy B).

Analyzing the trading from massive melt up (without “the blue sheets”, even) that started in early October and reached its zenith in late November, I determined that approximately 83 million shares traded hands, with a volume-weighted average price of $6.31 (about $1.04 Billion in market cap):

Source: Bloomberg

What’s clear from the above, is that a lot of investors paid a “robust” price for this thing, given where it had traded in the year prior to the big runup.

If you’re at all familiar with the old Torchlight Energy, who via the process outlined in my last article, now reside in Next Bridge Hydrocarbons after being distributed to MMTLP shareholders, you are probably bracing yourself a bun fight about bajillions of barrels of, the value of the Orogrande basin as a prospective energy “play” and so on. No need! Meta Materials, valuators hired by MMAT, and NBH itself have provided everything I’ll discuss here.

At the time of the MMAT/TRCH reverse takeover, MMAT was required to record the liability associated with the MMTLP preferred shares at fair market value as a “preferred stock liability”.

To value this liability (i.e. MMTLP), the company engaged an independent valuation firm to value all of that company’s oil and gas assets as at the time of the acquisition, and for subsequent reporting periods. Below is the relevant note to MMAT’s December 2021 10-K:

Source: Meta Materials December 2021 10-K

This is the source of the $72.6 million liability on MMAT’s balance sheet at the time of the RTO as shown below:

Source: Meta Materials December 2021 10-K

The March 31 2022 10-Q provides some additional color on the independent valuation - performed by Roth Capital Inc. and an engineering reserve report conducted by PeTech:

Source: MMAT March 31 2022 10-Q

It’s also worth noting KPMG, MMAT’s auditor, considered the valuation of these assets as a “critical audit matter” and involved its own specialized valuation professionals to review the work of Roth and PeTech, in signing off on the 2021 audit:

Source: MMAT 2021 10-K

Pausing to run a bit of math here, the $72.6 million valuation works out to about $0.44 per MMTLP share. At the upper bound of the valuation ($101.1 million), that works out to about $0.61 per share.

MMAT dutifully updated this valuation work for the remaining quarterly reports in 2021. The table below summarizes the valuation, along with the corresponding value per MMTLP share:

Source: MMAT SEC filings, Keubiko calculation per share

You might be thinking that you would like to meet the person paying $12.50 per share for an asset that the company, its valuators, its auditor, and its auditor’s experts valued in the 43 cent range. You go right ahead and meet that person. I’ll wait in the car. With the doors locked.

Moving on, let’s now refer to the S-1 filing from Next Bridge Hydrocarbons associated with the MMTLP distribution. It describes a $15 million dollar loan advanced from Meta Materials. Important for our valuation discussion, this loan is secured by a lien on a 25% interest in NBH’s oil and gas asset - the Orogrande Project. See below:

Source: Next Bridge Hydrocarbons S-1

The loan is also collateralized by 1,515,000 MMAT shares owned by an NBH shareholder, but that’s not really important for our purposes. What is important, however, is what showed up in the December 31, 2022 10-K from MMAT. See below:

Source: MMAT 10-K

Remarkably, MMAT has written this $15 million loan receivable down to only $2.2 million - just the value of the pledged MMAT shares. It uses the following explanation (CAPS added for emphasis):

"…determined that except for the security interest in our shares held by the Pledgor for the secured loan, THE OTHER COLLATERAL IS NOT SUBSTANTIVE and therefore should not serve as the basis for concluding that the loan is well secured and collateralized;”

In other words, MMAT is valuing a lien on 25% of NBH’s energy asset at ZERO. It’s unclear to me why they were ascribing a $71.7 million value on September 30, but by December 31 seem to have made a different determination, at least when it comes the credit quality of this note.

The $15 million note was actually due on March 31, 2023, however MMAT agreed to extend the maturity. I can only conclude it’s because NBH couldn’t pay, as MMAT certainly could have used the cash, as evidenced by a massively dilutive capital raise announced just two weeks later.

We have one final data point to look at. While NBH does not trade, it is technically a public company under securities laws due to the number of shareholders the company has. As such, it needs to file documents with the SEC just like other public companies. Because of this, we can see a series of Form 4s filed on March 8, 2023, whereby management is being issued many millions of stock options. The exercise price on these options is a very specific (out to four decimal places) $1.2056 as shown below in the CEO’s ~5 million share grant:

Source: SEC Filings

I went digging for the source of the $1.2056 and found it in the company’s amended 10-K/A filed just 10 days ago (amended to include items such as compensation that would normally appear in proxy documents). The relevant section is shown below:

Source: Next Bridge Hydrocarbons 10-K/A

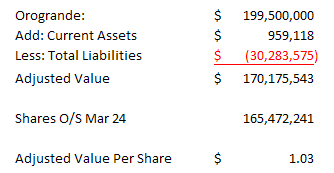

You can see that NBH is now using a value for the asset of $199.5 million for the company’s working interest in the Orogrande Project. This does strike me as a bit odd for a few reasons. First, why is MMAT’s 10K seemingly valuing Orogrande at a big fat zero, and why is NBH suddenly using an amount nearly 3x what MMAT had been carrying it at? No big deal I suppose.

Second, the 10-K/A notes that as of March 24, 2023 (just after the option grant), there were 165,472,241 NBH shares outstanding. Running the simple math of $199,500,000 / 165,472,241 we get exactly the $1.2056. figure. But…

It seems NBH, in making those grants based on that simple formula, did not adjust for over $30 million in liabilities on the NBH balance sheet, including nearly $25 million owed to MMAT:

Source: Next Bridge Hydrocarbons 10-K/A

Had they adjusted for that debt, I estimate that the strike price on the options would have been approximately $1.03 per share:

Source: Keubiko calculations based on company filings.

Putting it all together, we have a range of values between $0.00 (the collateral value that MMAT is now using for its loans), to an absolute maximum of $1.2056 (but really closer to $1.00, if one accounts for the net liabilities) based on NBH’s own estimate of “fair market value”.

It does seem remarkable that MMTLP owners had a chance to sell these shares at more that $12.00 and the volume weighted average price in the final two months was over $6.00. Hopefully the oil riches will flow in the coming years.

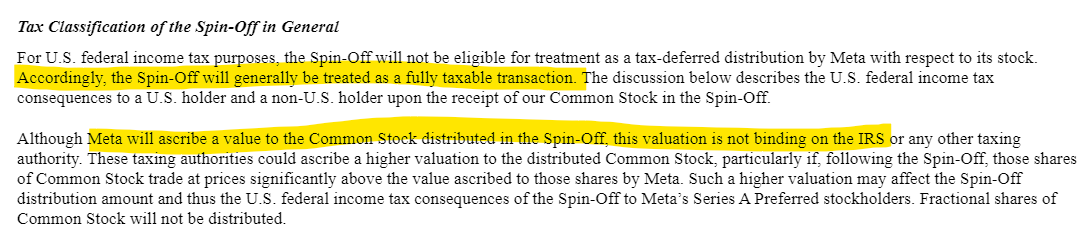

In the meantime, those diamond-handed folks that held on and received the NBH distribution, may have some fun with the IRS, if one is to believe the S-1 filing associated with the spinoff. The S-1 notes that the Spin-Off of MMTLP “will generally be treated as a fully taxable transaction”:

Source: S-1 Filing

It further goes on to note that Meta Materials intends to issue an IRS Form 1099-DIV, but that “This information may not be available util after U.S. holders file their U.S. federal and state income tax returns for that taxable year, and as such U.S. holders may need to file amended tax returns…”

Source: S-1 Filing

There is a lot of other tax discussion in the S-1, and tax law is complicated, but it seems like there is another potential shoe to drop in 2023 if from MMTLP holders get a tax bill. Would the IRS look at the $2.90 last closing price and assess tax based on that? This will be an interesting development if and when Meta Materials gets around to issuing the 1099-DIV mentioned in the S-1. Consulting one’s tax adviser seems to be a prudent course of action in such situations.

"Credulity is always greatest in times of calamity. Prophecies of all sorts are rife on such occasions, and are readily believed, whether for good or evil.” - Charles Mackay

Great article. A disaster for anyone who listened to Youtube influencers instead of reading SEC filings.

Great article.