No, Michael Burry hasn't YOLO'd 40% of his fund on Tesla put options

Hold my calls, someone is wrong on the internet

“A lie can travel halfway around the world before the truth can get its boots on.”

- Mark Twain

One day I might write a detailed article on the myriad problems with SEC-mandated 13F filings.

Nope. Today’s rant is just a quick commentary on the state of affairs in our financial media and the investor community at large. And it serves as yet another reminder that there is no substitute for educating yourself and doing your own work. Or just read my stuff. Whatever.

Section 13(f) of the Securities Exchange Act of 1934 requires investment managers with discretion over $100 million in applicable securities to file quarterly reports on certain holdings within 45 days of each quarter end. Fund managers enjoy this as it involves constantly giving away their intellectual property in exchange for nothing.

One of the favorite pastimes of lazy investors and charlatans is to scrape other managers’ 13F filings for investment ideas. Why do your own work when you can just follow a “guru” and charge your own clients for that value-add? (Disclosure: I too like to whore ideas from 13Fs).

One key thing to note is that Form 13F filings only contain long positions. This, combined with the 45-day delay, means that some 13Fs are more useful than others. A 13F from a high-frequency trading long/short manager has almost no value at all. A 13F from a low-turnover long-only manager is different, which is one of the reasons why drooling value investors salivate over the the latest Berkshire Hathaway or Baupost 13Fs.

Yesterday and today, headlines across financial media were filled with the “news” that Michael Burry, a very smart investor feature in the Michael Lewis book (and film) The Big Short, has placed an enormous bet against Tesla. Below are just a handful of the headlines:

And it’s not just the purported size of this bet, but its size relative to his fund’s assets under management (AUM). “40% of his total portfolio!” according to various Twitter loons:

Some red-faced clowns, foaming about the mouth over their recent Tesla investing travails, even took to begging Elon Musk to “Squeeze shorty” based on this “fact”

Even Sergio the “Not followed by anyone you’re following” twitter rando piled on from parts unknown.

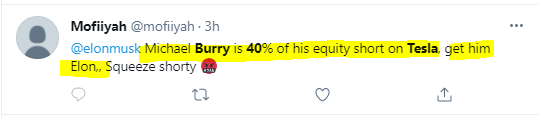

Where does that 40% come from? Well, the front page of the 13F from Burry’s Scion Asset Management sums the total holdings in Column 4 of the Information Table, so a someone “doing his or her DD” (as they like to say on Stocktwits) might be forgiven for assuming this number is assets under management:

So $534M is indeed about 40% of $1.35 Billion. Our “DD” is done, right?

Before we drill down into what is going on here, let’s take a step back. Would a professional money manager really YOLO 40% of a fund on OPTIONS on a single name? Especially one of the top weightings in the S&P 500? Perhaps, but a thinking person would start asking questions about how reasonable this is.

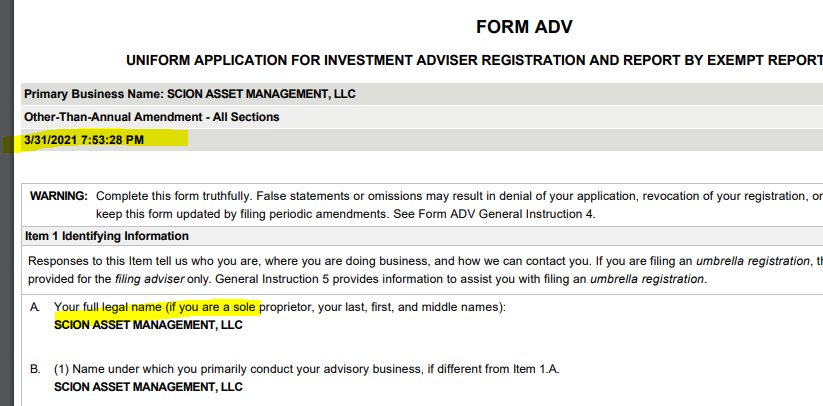

The Scion 13F is dated March 31, 2021. If we were interested in learning what Scion’s actual AUM is, we could simply go to the document that actually discloses this, the Form ADV which all investor advisers file annually, and which are public for firms over $25M. Scion’s Form ADV can be found here:

https://reports.adviserinfo.sec.gov/reports/ADV/167772/PDF/167772.pdf

Conveniently, it happens to be dated the exact same day as the Form 13F filing:

The Form ADV shows that AUM is actually $639M

Now don’t rush to Twitter and be this guy, keep reading.

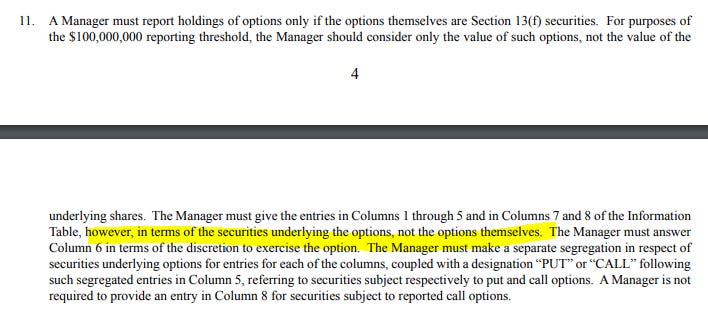

Here is the core problem with all of this nonsense. Even thought Column 4 of a 13F Information Table is titled “VALUE”, this does not mean market value for option positions. “Do your DD” and look at the 13F Instructions on the SEC website (found here: https://www.sec.gov/pdf/form13f.pdf) and pay particular attention to the highlighted portion below:

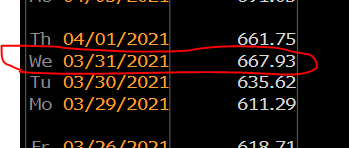

What does that mean? It means that the “VALUE” reported in Column 4 for options on Form 13F filings is for the shares represented by the options, not the options themselves, and thus have no bearing on the actual market value of the options. Indeed on Burry’s filing, we know that there are 8,001 option contracts. Each contract covers 100 shares so there are 800,100 Tesla shares represented by the put contracts. Tesla’s closing price on March 31, 2021 was $667.93:

If we multiply $667.93 X 800,100, we get $534,410,793, which is the exact number reported in the Scion 13F. Hooray for the lost art of math.

All we know for sure is that as of March 31, Burry owned 8,001 put option contracts on Tesla. We have no way to know strike price(s) or expiry date(s). To use an extreme example, these could be January 22 $5 strike put options that you can buy as of right now for $0.01:

In such a case, the 13F “VALUE” on March 31 would still be reported as $534 million, but the market value of the total option position would really only be $8,001.00 in total. Also, LOL at the person that bought 224 $1 strike Tesla contracts for a penny today at a total cost of $224.00. Probably a raging Bitcoin bagholder trying to get back at Elon Musk for barfing on his or her beloved Bitcoins.

It’s also worth noting that Burry’s Tesla put position(s) could be part of one or more spread trades, calendar spreads, or numerous other strategies. Short positions (including options) are not reported, which has the potential to further reduce overall exposure as a percentage of NAV.

Given Burry’s reputation as a high conviction investor, it’s unlikely that this Tesla put position (if he even still has it on, as this filing is 45 days old and Tesla’s stock price has been spanked in the meantime) is tiny, but it’s certainly a fraction of the amounts that are getting tossed around in the financial media (that should know better), and on social media.

May be I am too emotional, but I cant imagine my life without Keubiko. Without thoughts that he is outside somewhere doing fine, I collapse literally. I know it sounds girlish, but I truly put my soul in Keubiko.

Hey man, please take care if yourself. We love you so much!!! ❤️❤️

Keubiko strikes again