PSA: Bed Bath & Beyond Shares Are Toilet Paper Now

Don't listen to charlatans, YouTube grifters, and fools. Equity is a ZERO.

“A person who won’t read has no advantage over one who can’t read.” - Mark Twain

This brief article is for nobody.

People with any investing acumen and/or proficiency with second grade-level math knows that Bed Bath & Beyond (Ticker: BBBY 0.00%↑ soon to be $BBBYQ) is worthless, and will get nothing in the Chapter 11 bankruptcy proceedings. This article is not for you. Stop reading.

For those that currently own or “hodl” BBBY for any reason other than trying to offload shares to another brain-dead lummox, you already have no interest in such mundane things as “facts,” “math,” or “logic.” In fact, you aren’t even here reading this, because clicking on a link would be infinitely more “DD” than you’ve ever done. You are probably a version of this person:

Source: Reddit

Like I stated, this is an article for nobody. Perhaps some large language model AI will eventually ingest it, and it will make the the internet a slightly less baggy place one day. But it is not this day. Look at the below, and start weeping for humanity:

Source: Reddit

Shrek’s feeble loins and disloyalty to Princess Fiona notwithstanding, there is no equity value in BBBY shares and it is nothing more than a trading bauble and/or toilet paper. All information here will be taken from the bankruptcy case docket which can be found here: https://restructuring.ra.kroll.com/bbby/

First, let’s quickly review BBBY’s capital structure. The following “funded debt summary” comes from the declaration of the CFO/CRO (Document 10 on the docket):

Source: Docket

Of course, the above simply refers to outstanding debt instruments. It excludes other liabilities that also rank ahead of equity, such as accounts payable, leases etc. Per the bankruptcy petition, the company lists total debts at just over $5.2B, which would include the funded debt above (recognizing these amounts are stale, taken from the last 10-Q, but certainly worse since):

Source: Docket

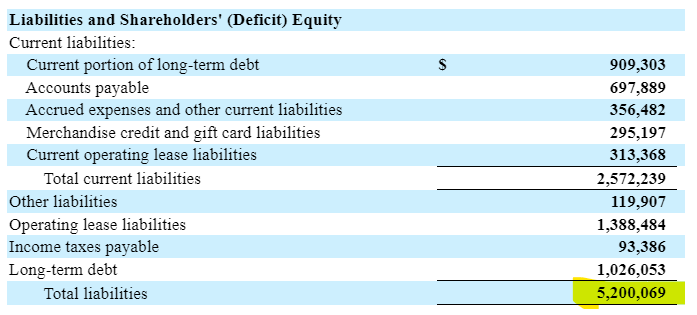

Below is a breakdown of the $5.2B taken from the 10-Q:

Source: 10-Q

Let’s be generous and assume that operating lease liabilities magically vanish, as does the tax man, as does “Other liabilities”. We’ll further assume that the gift card liability nearly $300 million evaporates, even though the there will be a mad scramble to use those gift cards as the filings state they will only be honored for another two weeks. Therefore we’ll only add Accounts Payable and accrued and other expense to our claims.

Finally, we’ll add in $40 million of Debtor-In-Possession (“DIP”) financing that ranks ahead of everyone (the total DIP is $240 million, but the DIP lender is pulling up $200 million of existing debt into the DIP) , to get the following very rough estimate of the claims that rank ahead of equity:

Source: Keubiko calculations based on filings and docket

Now let’s have a look at what the potential recovery may be in the Chapter 11 process. Critically (or terminally, if you’re an equity bagholder), as document 29 on the docket shows, there is no going-concern buyer for part or all of the business, even in conjunction with a restructuring. In total, 100 out of 100 potential suitors told Lazard that they were not interested in this particular dumpster fire:

Source: Docket

While they are still technically looking for going-concern buyers, they are immediately moving to rapid liquidation of all stores, and have engaged Hilco to liquidate the stores starting on April 26 and to wrap up no later than July.

Source: Docket

The recovery thresholds in the Hilco engagement letter provide a glimpse into what the sale of the remaining assets (namely inventory) will bring in:

Source: Docket

More specifically, the company estimates that the net sales proceeds from all “Sales” will be be $718 million.

Source: Docket

Of course, bankruptcies of cash-burning clown cars don’t come cheap, and accessing that $718 million in expected proceeds will cost a lot. A glimpse into how painful this will be is provided in the draft wind-down forecast in document 41

Source: Docket

For the first 5 weeks of the Chapter 11, to access $363 million of liquidation sale proceeds (along with other collections of $64 million), it will cost $221 million in operating costs. It seems the greedy store employees won’t volunteer their time for free.

Given the $363 million in 5 week sales proceeds is about half of the referenced total $718 million, it’s not unreasonable to just double the amounts above as a very rough proxy for what the proceeds will be here (ignoring other silly things such as legal and consulting expenses, employee severance and retention, court costs and so on). As such we’re looking in the order of about $400 million.

In such a scenario, a simplified waterfall would be:

Source: Keubiko calculations

The above is obviously very simplified, however it should be painfully obvious that even the secured debt is in big trouble here. The traded unsecured debt is now trading at $0.036 on the dollar (3.6% of par), which tells you what the bond market thinks.

Source: Bloomberg

Any equity holder that thinks shares are worth something is leaving a 27-bagger on the table with the bonds, with less risk (note: you’d have to be brain-dead to even think about buying those bonds, so stop thinking about that 27x).

“Someday, I will repay you. Unless, of course, I can’t find you. Or I forget.” - Shrek

I've missed this blog! Your "daily short volume" article was amazing for dunking on the baggies.

Great stuff