“You want it to be one way… But it’s the other way.” - Marlo Stanfield, The Wire

I’ve recently had the distinct pleasure of interacting with several former holders of “MMTLP”. I say “former” because the security no longer exists. Those lucky enough to be unfamiliar, consider yourselves blessed and stop reading. Ignorance is bliss. Trust me.

For those that truly crave the brain worms, you can find some good background information on the “situation” in this fine article from Doomberg:

A Forbes article that gives a decent enough (I give it a B+) overview can be found here.

If you want the VERY quick overview of what MMTLP is about, here is the most basic outline that I don’t think anyone, other than the most unhinged, would dispute.

In June, 2021, Meta Materials Inc. (a technology company) merged with Torchlight Energy (an energy firm) in a reverse-takeover transaction, becoming MMAT on NASDAQ.

Torchlight was not an empty shell, as is often the case with RTO transactions. The company had some legacy energy assets that, while not classified as reserves, were seen as valuable by Torchlight’s (largely retail) shareholder base.

In recognition of these non-core energy assets, Torchlight, prior to the RTO, created a preferred share (the now-infamous “MMTLP”, which became its OTC ticker), to ensure the economic value of the energy assets would only accrue to the legacy Torchlight shareholders.

As the energy assets were not sold, ultimately Meta Materials distributed shares in the spin-off entity, a non-traded (yet technically public due to the large shareholder count) company named Next Bridge Hydrocarbons (“NBH”). After the distribution of all of its value, MMTLP was then cancelled, per the announced plan. NBH’s transfer agent has confirmed this has taken place.

For reasons that may become clear, many holders did not sell their MMTLP shares prior to the corporate action, either because they did not understand key dates surrounding the event and/or because they expected to both receive the NBH distribution AND sell the empty ex-distribution shares to “someone else” before cancellation.

The fact that FINRA halted trading in MMTLP for the two-day period between the when the shares went ex-distribution and when they were cancelled has also fueled conspiracy theories that the FINRA halt was done to protect short sellers, naked or otherwise, or even more extreme theories such that FINRA itself was shorting MMTLP.

In brief, and in broad terms, these holders are apoplectic for one or both of the following reasons:

They never wanted to be “trapped” in NBH, and FINRA robbed them of the ability to get out.

FINRA’s halt prevented what would have been a massive short squeeze, thus robbing them of untold riches.

Fueling those two core (and yes wrong) grievances are a cacophony of (also wrong) beliefs that this community of the damned has convinced themselves are to be taken as facts, such as:

There are a bajillion “counterfeit shares” from “naked shorting” of MMTLP

Many of the NBH shares that are distributed are also counterfeit, and tales of “fake CUSIPs” abound

It’s illegal to “carry a short into a private company” (their phrasing, not mine)

It is to these folks that I address the following letter:

Dear Former Owner Of MMTLP,

Most of you will not absorb what I am about to tell you, but perhaps a few of you, 6 months on, just might start to open your minds to the possibility that you bear much, if not all, of the responsibility for what has happened to the money you invested in MMTLP. I’ll try keep things simple and to the point. My goal is not to have you take my word for anything, but to perhaps question some of the things you believe or are being told.

For those of you that feel trapped in NBH and believe it was FINRA that did you dirty in that regard, it’s important that you understand some basic things about trading and settlement of securities transactions. Stocks trade on what is known as “T+2 settlement”. If you buy or sell shares on a Monday, the trades settle on Wednesday (trade date + 2 days). With that in mind, let’s review the key dates from the MMTLP corporate action that were announced well in advance:

Source: FINRA

The FINRA corporate action notice above was put out on December 6. That left the remainder of that day, plus December 7, plus December 8 to be able to interpret the corporate action and make trades in the MMTLP. Meta Materials even press released the corporate action on December 7, and the MMAT CEO tweeted it out on December 6, thanking FINRA:

Source: https://twitter.com/palikaras/status/1600227867148767232?s=20

In short, if you have chosen to manage your own investments, you have an obligation to yourself and to your family to monitor developments. There is no excuse for at least not being aware of the basic details of this corporate action. You had every opportunity. Many of you even read the CEO’s tweet, and thanked him in the replies. Take Dave here for example:

How It Started:

How It’s Going:

It’s always someone else’s fault, right?

Armed with the corporate action dates that were known well in advance, it may be helpful to plot them on a Calendar:

All of the dates and details above were known by December 6. December 8 was always the date by which you had to sell MMTLP to receive cash (from a buyer), instead of the NBH shares (along with a possible tax bill, but let’s not go there). It was always the date by which someone had to buy MMTLP in order to receive the NBH distribution. Finally, it was always the date by which any remaining short sellers would have had to buy MMTLP to avoid liability for the NBH distribution. Trades occurring on December 8 settled on the 12th, the record date.

If you are one of the seemingly 10s of thousands of former owners of MMTLP that feel “trapped” in NBH, you were trapped by your own ignorance. Regardless of what FINRA did or didn’t do after December 8, if you didn’t sell by end of day on the 8th, those NBH shares were coming your way whether your wanted them or not.

Which brings us to our next point of discussion. The ONLY value that MMTLP had, or was ever going to have, was the NBH distribution. As shown clearly above, AFTER December 8, MMTLP was nothing but an empty bag of air heading for cancellation on December 13.

Let’s assume FINRA did not halt the stock on the 9th and 12th and think about what our MMTLP world would have looked like on those days:

First, armed with our knowledge above that stocks trade on a T+2 basis, any trades in MMTLP on December 9th would settle on the 13th. Trades on December 12th would settle on the 14th. You may notice a problem, as December 13th was the cancellation date of the shares, and December 14th was obviously after this. FINRA stated that concerns about settlement were one of the reasons for the halt. That is entirely logical as it’s hard to settle a security that no longer exists.

Second, anyone purchasing MMTLP shares on the 9th or 12th would receive no NBH distribution, nor would they even receive anything on settlement. An instant, guaranteed zero. Many brokers would not even allow purchases of this worthless bag of air during this period. So who would be left to buy? Who would buy an empty ex-distribution security that would be cancelled before the trade even settled? Nobody rational. Which brings us to our third point on what would happen if we had those “two days” back: “the shorts”.

Many, if not most of you, seem to have the belief that there were a large number of short sellers of MMTLP, and they would have been forced to close out their position by the 13th. Some of you point to the notion that you “can’t be short into a private company”, while others believe brokers or prime brokers would have forced short sellers to cover by the 13th. All of these beliefs are deeply misguided, so let’s get into it.

Even if you believe that the NBH distribution was the catalyst for short sellers to cover, the key thing you are missing here is that the liability for NBH attached at the end of day December 8. Anyone short end of day December 8 is on the hook for NBH. Full stop. If they covered say on December 9, their trade would have settled on the 13th (ignoring the settlement problems already highlighted) which is AFTER the December 12th record date. In other words, covering on the 9th or 12th would not get a short seller out of the NBH liability. It would have done nothing for them.

Apart from not getting them out of their NBH liability (which attached on the 8th), short sellers, contrary to urban legend, are not required to cover a cancelled security. Whether by way of voluntary cancellation as was the case for MMTLP, or cancellation by a bankruptcy court in other names, it just doesn’t need to happen and virtually no brokers (and zero prime brokers) would require it. In fact, if it traded at all on the 9th or 12th, any price above $0.00 would be free money for any new short seller.

Key takeaway here: All of the pressure for a squeeze or short covering rally to avoid the NBH liability had to occur on by December 8. After that, covering MMTLP would have been a waste of money for a short seller.

So, with no natural buyers of MMTLP on the 9th and 12th, who would have bought the empty bag of ex-distribution shares from you? FINRA, likely seeing the circus surrounding the name, rightly stepped in to protect prospective buyers from buying a worthless instant zero.

FINRA did its job.

Perhaps you were robbed of the ability to both strip 100% of the value of MMTLP (the NBH shares) AND sell the worthless shell to a total chump. However, that narrative does not evoke much sympathy from me or anyone else. It just would have resulted in a different group of folks picketing the FINRA headquarters.

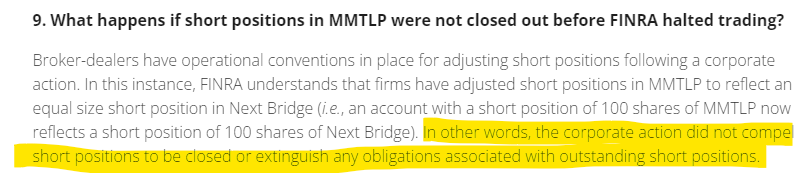

As to the assertion that shorts would have to cover because it’s “illegal to carry a short position into a private company”, I’ve demonstrated already that they would have had to cover by the 8th, but it’s also just flat out wrong. Non-cash distributions are relatively common in capital markets. Many short sellers would choose to cover to avoid the hassle of keeping a position on the books, but there is no “law” stating that a short seller has to cover in advance of a non-cash distribution. They simply remain liable. Securities lending arrangements are also clear that if someone is long a security with an upcoming distribution but the shares are on loan, they need to recall those shares to receive the form of actual distribution. Otherwise, they may simply have to wait, or may accept a cash payment in lieu of a distribution, depending on the situation. The “MMTLP FAQ” that FINRA put out on this point should be visible, even through tears of rage:

Source: FINRA

Now let’s address the (largely irrelevant) notion that that there were “a lot” of short sellers in MMTLP. We’ll do something crazy and look at the data.

Source: https://otce.finra.org/otce/equityShortInterest

The data above shows that as of the last reported date (November 30, 2022), short interest was down to only 4.6 million shares, or about 2.8% of the MMTLP shares outstanding. This was a decline of 27.5% from the prior two weeks and, given the elevated volume, represented only 1.47 days to cover. This data shows that the small amount of short sellers (only $36.8 million total value of a $1.35 Billion market cap at the November 30 closing price of $8.17) were covering aggressively heading into the key date of December 8. It’s possible, if not likely, the short interest was near zero by then.

Many of you will be upset at the above paragraph, as it contradicts a belief, deep in your tummies, that there must be hundreds of millions, if not billions of “counterfeit naked short shares out there.” I can’t prove that this isn’t the case, in the same way that I can’t prove Bigfoot doesn’t exist, but we can look at some of the reasons that several of you point to as being proof or indicia of the big bad naked shorties out there.

An oft-citied trope that many of you are hanging your hats on is that the “daily short volume” on MMTLP and many other securities were evidence of massive short selling activity, and since this massive volume does not show up much in the twice-monthly short interest reports, it must be “naked” or “counterfeit”. Unfortunately, this is due to misinterpretation of the data, and the very real fact that the vast majority of reported “daily volume” has nothing to do with actual short selling by short sellers. It’s simply market mechanics of how trades are executed.

FINRA tried to explain it here: https://www.finra.org/rules-guidance/notices/information-notice-051019

I tried to explain it here:

Misunderstood and Misused - "Daily Short Volume"

“The truth is more important than the facts” - Frank Lloyd Wright How many times have you seen something like the below exchange play out on social media (e.g. Twitter or its lowbrow bastard child Stocktwits)? If I had a Dogecoin for every time I read a post about “daily short volume”, I’d have a lot of worthless Dogecoin. While it would be easy (and q…

And as recently as YESTERDAY, OTC Markets released a blog trying to explain the damaging misinterpretation of this data here: https://blog.otcmarkets.com/2023/05/08/what-investors-should-know-about-finra-daily-short-sale-volume-data/

I beg you to read one or more of these valuable articles and share them far and wide. For now, I’ll post this screenshot from the above-referenced OTC blog:

Source: OTC Markets

I was both saddened and bemused to notice at least two of the lawsuits filed regarding MMTLP are also using this misinterpretation of daily short volume as foundational arguments.

I already know what some of you may be thinking now: “It’s not the shorts then, it’s the MMs!!!!! The market makers!!! Using their market maker exemption to hold us down!!!”

I’m steering clear of the more extreme conspiracy theories about market making, but will simply note that the market maker exemptions described in Reg SHO are very narrow, and can be utilized only for a brief period of time (and practically often last mere seconds or milliseconds), after which a borrow must be secured or a position closed out. Absent this requirement, a market maker would have a growing liability to the clearing agency which would then be required to take action. Below is a summary of Rule 204 - Close-out requirements, from the SEC:

So yes, a market maker could take a number of days to settle a failed trade, but failures to deliver are rectified within a short period of time due to close out requirements (not to mention market makers being in the business of making markets, not taking directional bets). Specifically to MMTLP, FINRA clarified that MMTLP did not have fails-to-deliver that would have made it a “threshold security” under Reg SHO.

SOURCE: SEC

Source: FINRA

As an example, supportive of FINRA’s statements, I pulled the FTD data for the active second half of November 2022. As shown below, FTDs were a miniscule percentage of MMTLP’s 165.5 million shares:

Source: SEC FTD data, Keubiko calculations

Lastly, let’s briefly touch on this “fake CUSIP” nonsense. Many seem to be claiming they don’t have “real” NBH shares, because their broker has assigned an internal code or placeholder to their shares. Some of you conclude these must be “counterfeit” shares sold by “naked shorts”. Take the following tweet, for example:

Most, if not all, of this confusion stems from a lack of understanding about how securities are held and registered at brokerage firms. Brokers hold most securities in “street name” via a nominee entity. There are three ways to hold securities: physical, direct, and “street name”. The table below from the SEC offers a simple explanation of each:

Source: SEC

Street Name registration offers many advantages that you can read about here. In any case, NBH confirmed that by February 16, all NBH shares were distributed. If you have an internally assigned CUSIP or placeholder, it’s highly probable that your shares are held in street name. You can choose to work with your broker’s back office and NBH’s transfer agent if you wish to directly register them:

Source: Next Bridge Hydrocarbons

One thing I do believe is that FINRA would have been well-advised to announce the trading halt on December 6 when it produced the corporate action notice. Had it done so, it might have focused the minds of those that mistakenly thought they still had time to “get out”, or sell a worthless bag of air to chumps and shorties. Had it done so, I believe the net result would have merely been increased incremental selling pressure on the December 8 and a likely lower share price.

In conclusion, if you feel that you’ve been “done dirty”, you really only have yourself, and possibly some people that fed you misinformation, to blame. You will not get “two days back”. You will not get two seconds back. You have everything you are entitled to (a non-trading share of NBH, which I hope works out for you). All the short covering that was required or desired was done on or before December 8, and FINRA gets a solid B+ or A- on how it handled the corporate action.

Sincerely,

Keubiko

P.S. I have never had any position whatsoever in MMTLP.

“Money ain’t got no owners, only spenders.” - Omar Little, The Wire

I wrote this article myself, and it expresses my own personal opinions only. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. It is not a recommendation to buy, sell, short, hold, or avoid any security. It should not be relied upon for any purpose other than entertainment. Numbers and analysis presented have not been proof-read or independently verified. Assume I am goofball. I’ve been called worse by better than you. Despite my best efforts I make mistakes. I do get it wrong sometimes. Do not assume I will update or comment further. Always consult a financial advisor. Better yet, buy an index fund. Be a good person.

Excellent article. If God came down and wrote this article the baggies would fight with him.

Doing God's work!