Clover Health (NASDAQ: CLOV) has been heavily traded over the past few weeks. Many “investors” have been under the mistaking notion that the short interest is higher than the float (as outlined in a prior substack article (see here.)

Others seem to be under the bizarre notion that insiders can’t sell their stock until the the shares (currently in the teens) are over $30 for 30 consecutive days, as evidenced by this loon:

The promise of lucre has been too much to resist, some have managed to make money on the volatility. Take our Reddit friend below, for example:

It’s not certain if he made $1,000 on the couch PLUS another $1,000 on “the shitter”, is double counting the couch bucks with the shitter bucks, or if he has a combination couch/shitter (perhaps a prototype for another Chamath SPAC or Softbank startup?).

In any case, we can clear up the “$30 for 90 consecutive calendar days” nonsense by pulling up the prospectus and noting that this oft-quoted drivel only refers to a handful of Restricted Stock Unit (RSU) awards, and are unrelated to the large amount of shares owned collectively by management and insiders.

Some excitement also exists about the likelihood of of Clover being added to the Russell 2000 index later this month, along with other high quality outfits such as Arcimoto ($FUV), the electric tricycle maker adored by some of the brightest investment minds around, surely in no small part due to its fun-loving CEO that woos investors with banjo music on earnings calls:

But let’s not get off topic. If interested, you can see see the full preliminary list of Russell index additions here. Of course, the same jokers that will tell you that CLOV’s float is so so small for short squeeze purposes won’t be quick to point out that the Russell index methodology is float-adjusted as well.

Separate from all of this noise is a far more important (in my view), yet little-discussed matter that could have a material impact to Clover’s share price over the coming weeks and months. I’m referring to hundreds of millions of shares of CLOV currently worth over $3 Billion coming out of lockup on July 5.

Before we get into the math, here is a quick review of Clover’s equity structure based on its most recent 10-Q filing (for Q1 ended March 31, 2021):

Class A shares are the listed securities of Clover. Like good little tech bros, management and founders don’t want Reddit troglodytes and other shareholders having any sway over the company. As such, they have managed to hold the bulk of their stake in unlisted Class B shares, each of which has 10 votes per share vs. 1 vote for steerage class (yes I know Alphabet and other tech companies have multiple vote share classes as well so STFU about that).

Per page 63 of the Clover 10-K - Class B shareholders can puke over 223 million Class B shares (about 86% of Class B shares) before the remaining shares are converted to Class A, retaining (collectively) control of the company.

Class B shares can be converted into Class A (the publicly-listed class) at any time at the option of the holder

Whilst some bozos focus on on the Sponsor’s (SCH Sponsor III LLC - the Chamath entity that received 20,500,000 for a grand total of $25,000) agreement to refrain from selling its shares for a year unless the shares exceed $12 for a 20-day period beginning 150 days following the IPO….

…they seem blissfully unware that on July 5, 2021, over 198 million Class B shares come out of lock-up, along with over 15 million Class A shares, including 10,000,000 shares owned by Chamath via “ChaChaCha SPAC LLC”., shares that have a cost basis of $100 million ($10 per share).

The lock-up provisions are located in the Amended and Restated Registration Rights Agreement filed with the SEC here:

https://www.sec.gov/Archives/edgar/data/1801170/000119312521007348/d63659dex101.htm

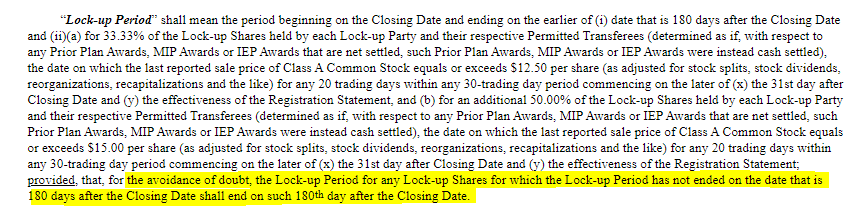

The Lock-up Period is defined in the agreement as follows:

In other words, every share covered by this agreement comes out of lock-up on July 5, 2021, being 180 days following the closing date. “Doing our DD” a little further, we can see that the 10-K Risk Factors explicitly point this out and confirm the July 5 date:

Cross-referencing the “CHI Holders”, “Holders”, “Director Holders”, and “Investor Stockholders” covered by the lock-up with the holder disclosures in other SEC documents, I constructed the following table:

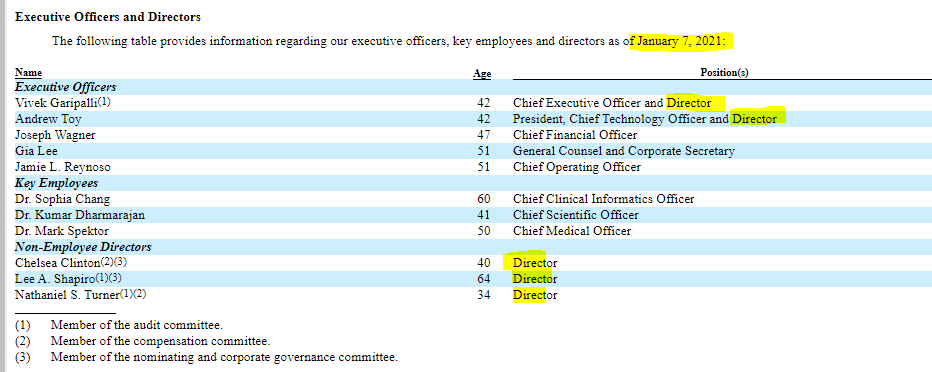

I estimate that approximately 214 million shares come out of lock-up on July 5. At the current price of around $15, that is over $3 Billion worth of stock. The vast majority of these shares are from three parties: 83.6 million shares owned by founder and CEO Vivek Garipalli (via 5 LLCs he controls), 96.3 million shares owned by entities affiliated with Greenoaks Capital, and Chamath “I am the next Warren Buffett” Palihapitiya for 10 million shares.

We have no way of knowing if or when these shares (or shares owned by other insiders such as Chelsea Clinton) may hit the market. However, given the “meme” stock status of Clover over the past weeks and the “robust” (in my humble opinion) valuation, I would not be surprised to see significant sales which could not only pressure the shares, but also increase what is now a fairly small float of Class A shares, potentially threatening its “high short interest as a % of float” meme stock status.

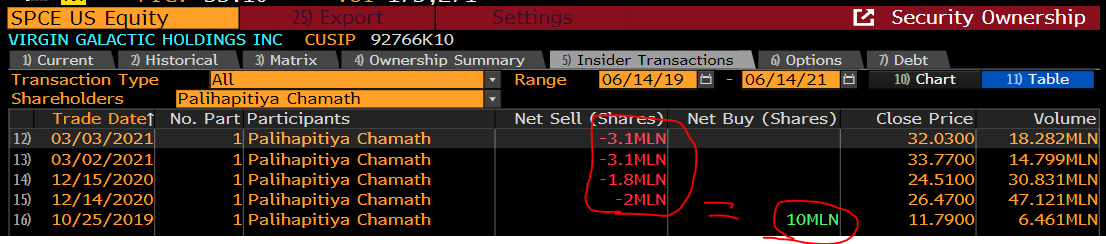

It’s worth remember that Chamath had no problem blowing out 100% of is Virgin Galactic (SPCE) holdings (at least those that he had paid for - while still hodling significant free sponsor equity).

When Chamath sold 6.2 million shares (to hold zero personally) of SPCE on two trading days in March, the announcement caused SPCE to drop 21% in the first two hours of trading on March 5 (the date the sales were announced).

Chamath had no qualms doling out the sass on Twitter, telling one young disciple to “stop crying and do your own work.” Pretty good advice, actually.

It would not surprise me one bit to see Chamath sell some or all of the 10 million “ChaChaCha” shares, especially if he could recoup all of his risk capital plus, at current prices, a $50 million profit, while still enjoying significant upside of 20,500,000 Sponsor shares with nominal cost basis that have a longer lock-up period.

It’s also worth noting that, per Clover filings, Chamath’s 10 million share of soon-to-be-freely-tradable Clover stock has been pledged as collateral for a loan agreement with the cracker jack risk managers over at Credit Suisse, perhaps offering more financial incentive to monetize these shares sooner rather than later.

It will also be interesting to see what potty-mouthed founder and CEO Vivek Garipallis does with his shareholdings, currently worth about $1.3 Billion, when out of lock-up, although he may be subject to a blackout period until Q2 results are released.

As for Greenoaks Capital, Clover’s largest shareholder with 96.3 million shares, it’s interesting that in May 2016 when Greenoaks injected $160 million in to Clover in a Series C round, Greenoaks partner Benny Peretz joined the board of Clover…

… and in the merger agreement with the SPAC, Peretz was granted a board seat…

…however by the time the S-1 was filed he (nor any other Greenoaks representative) was listed.

It’s not clear why Greenoaks, despite being the largest shareholder of Clover, does not have a representative on the board. One benefit of not being a director is that trading blackout periods may not apply as they would to officers and directors, so perhaps they seek more flexibility. Greenoaks is another entity to watch following the July 5 lock-up expiry.

With Clover Health shares trading an average of about 120 million shares per day over the past 15 sessions, it’s possible to move a lot of stock before having to file a Form 4 insider sale disclosure two business days later.

It’s possible all of these people have “diamond hands” and won’t sell a single share. It’s also possible they will be tripping over themselves to capture a share price bid up by retail traders trying to “own the suits” (nothing owns the suits more than buying stock from billionaires at inflated prices) and other traders. Don’t cry if they do.

“One of the things I have known my entire life is that I have an innate capability for making money.” - Chamath Palihapitiya

—————————————————————————————————————-

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Assume I have a position. This article represents my personal opinions only. It is not a recommendation to buy, sell, short, hold, or avoid any security. It should not be relied upon for any purpose other than entertainment. Numbers and analysis presented have not been proof-read or independently verified. Assume I am goofball. Despite my best efforts I make mistakes. I do get it wrong sometimes. I welcome comments and corrections. Do not assume I will update or comment further on a name. Always consult a (non-douchebag) financial advisor. Better yet, buy an index fund (scratch that, indexes are turning into clown cars lately). Be a good person. Stop crying and do your own work.

First day of lockup expiry and $CLOV is getting Chamathed. down 14.8% to $9.97.

Pure gold!